The Ultimate Guide to the Toronto Condo Market in 2025

The Toronto condo market is navigating a complex landscape marked by declining prices, increasing inventory, and shifting buyer sentiment. In this comprehensive guide, we will analyze the current state of the market. Specifically, our goal is to provide valuable insights for buyers, sellers, and investors alike.

Toronto Condo Market Overview: A Period of Correction

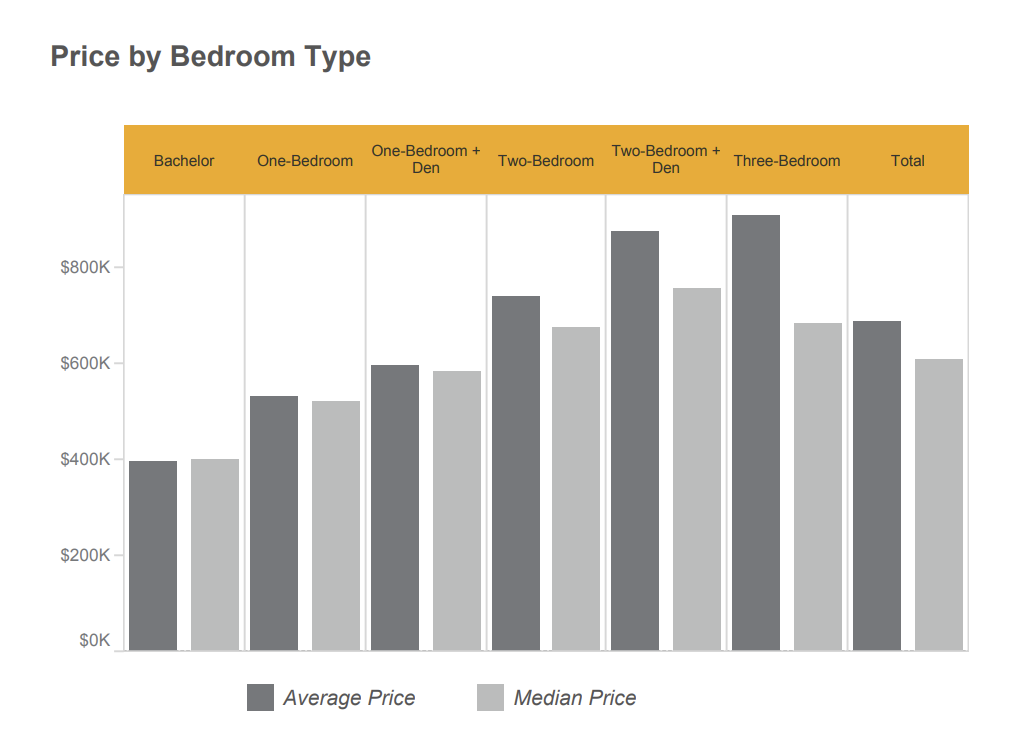

As of early 2025, the Toronto condo market is experiencing a notable correction. The average selling price for a condo apartment in the Greater Toronto Area (GTA) decreased by 2.6% year-over-year to $682,019 in March 2025.

This decline is more pronounced in the new condo segment, where the average asking price per square foot for unsold units fell to $1,524 in Q4 2024, down 10% from the peak of $1,689 in Q3 2022.

Sales volumes have also contracted, with condo sales dropping 12.1% year-over-year across the GTA in early 2025, although the decline is more significant in Toronto’s core (416 area). Comparatively sales fell 14.5% in Toronto’s core, versus 7.4% in the suburban 905 regions.

The price chart below was published by the Toronto Regional Real Estate Board.

Inventory Surge: A Buyer’s Market Emerges

The market is witnessing an unprecedented increase in condo listings. Active condo listings in the GTA nearly doubled from approximately 6,300 at the start of 2024 to 12,000 by year-end. Therefore, projections suggest this number could reach 15,000 in 2025, marking one of the most significant year-over-year increases in new listings.

Meanwhile, this surge in inventory has shifted the market dynamics, favouring buyers. The sales-to-new-listings ratio (SNLR) in March 2025 stood at 29%, indicating a strong buyer’s market.

Pre-Construction Condos: Facing Headwinds

The pre-construction Toronto condo market is under considerable pressure. In 2024, new condo sales in the GTA fell to 4,800 units. Overall, this is a significant drop from 12,633 in 2023 and 29,626 in 2021. Many projects have been cancelled or delayed. For example: 2,345 housing units were canceled between January and September 2024.

As well, Investors who purchased units at peak prices are now facing potential losses, as current market values have declined. Consequently, this situation may lead to financing challenges and defaults, prompting developers to offer incentives or convert projects to rental housing.

Rental Market: Balancing Supply and Demand

The rental market is also experiencing shifts. A significant number of condos set to be completed in 2025 were purchased by investors and are expected to enter the rental market. However, the federal government’s decision to reduce population growth targets, particularly the dramatic reduction in non-permanent residents, is anticipated to cool rental demand.

Accordingly, this combination of increased supply and reduced demand may lead to downward pressure on rents, affecting the profitability of investment properties.

Economic Factors: Interest Rates and Trade Tensions

The Bank of Canada has implemented six consecutive rate cuts, bringing the policy rate down to 2.75% by March 2025. Despite these cuts, the anticipated boost in housing demand has been muted. Economic uncertainties, including trade tensions and potential job losses, are dampening consumer confidence.

A Reuters poll indicates that Canadian home prices are expected to rise by only 2% in 2025, underperforming the projected inflation rate of 2.1%. This forecast reflects concerns over economic stability and its impact on the housing market.

Toronto Condo Market Outlook: Navigating the Road Ahead

The Toronto condo market in 2025 presents both challenges and opportunities. For buyers, the current environment offers increased selection and negotiating power. For sellers and developers, adapting to the evolving market conditions is crucial.

As the market continues to adjust, staying informed and working with knowledgeable real estate professionals will be key to making sound decisions in this dynamic landscape.

Check out our other articles:

The ultimate guide to semi detached homes Toronto